Monitoring of mobile robots in the first quarter: the overall growth of orders exceeds 30%

01 Difficulties in corporate profitability and financing in the overall market were still evident in the first quarter

Recently, according to incomplete statistics from the High-tech Robotics Industry Research Institute (GGII), in the first quarter of 2023, there were a total of 7 financing cases in China Mobile’s robotics/logistics and warehousing related fields. Subsidiary Huarui Technology introduced 8 investors to increase capital by 260 million yuan, etc., involving an amount of about 1.1 billion yuan, a year-on-year decrease of more than 50%. However, the single financing amount remained at a relatively high level.

Financing situation of mobile Robots/logistics and warehousing related fields in the first quarter of 2023

In addition, the GGII survey found that the first quarter of the mobile robot/logistics and warehousing related companies continued the capital winter of 2022, and the capital was still in a “flat” state, and the difficulties of corporate profitability and financing were still obvious in the first quarter.

In the field of domestic service robots, according to incomplete statistics from GGII, there were 15 financing cases in the first quarter of 2023, involving an amount of about 1.3 billion yuan. Significant decline; capital tends to start-ups, and the financing rounds are concentrated before the B round.

It is worth noting that from the perspective of segmented fields, the two major tracks of commercial cleaning robots and surgical robots continue to be hot, followed by rehabilitation robots and delivery robots.

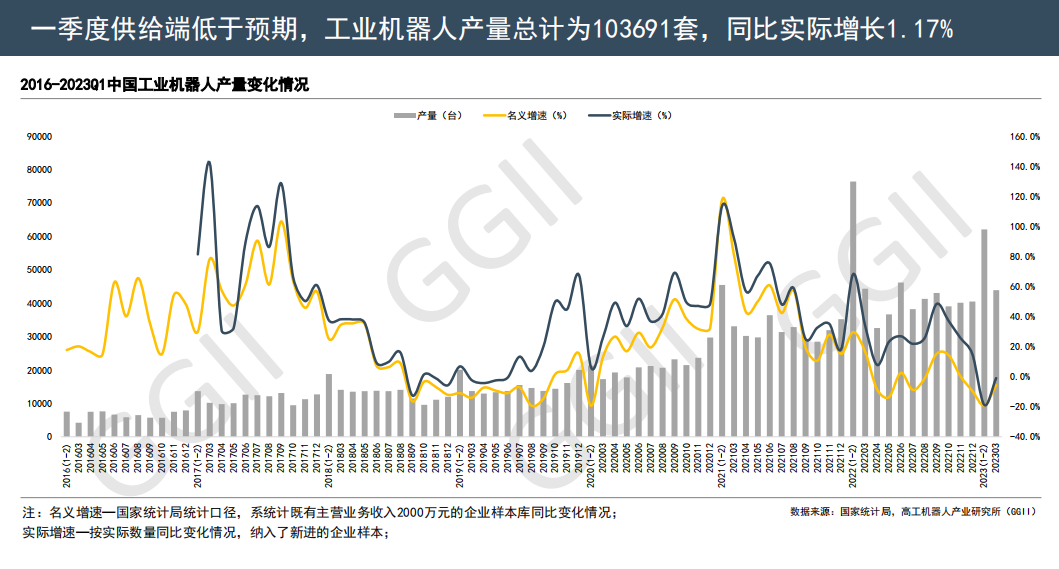

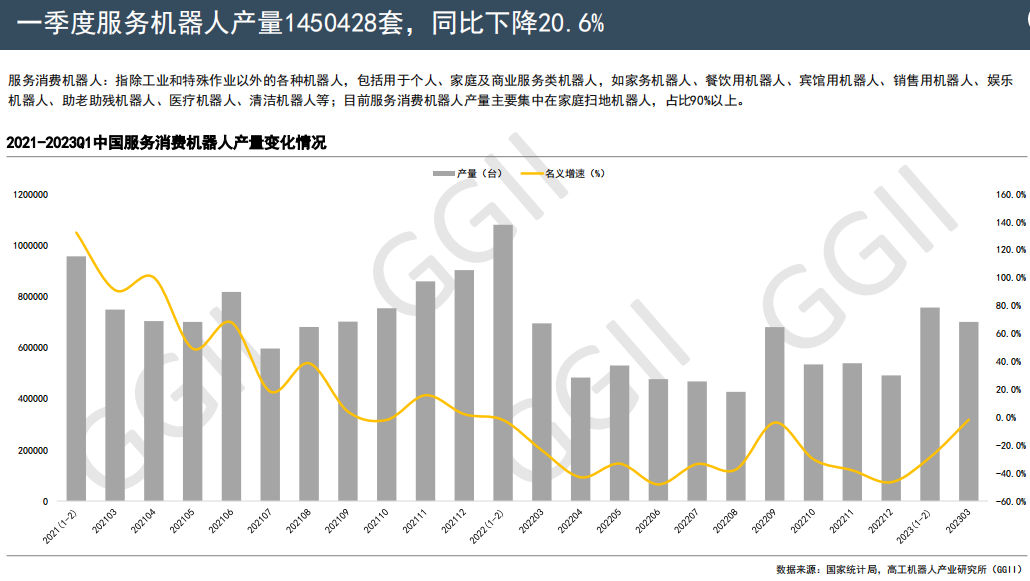

In terms of output, in the first quarter of 2023, China’s Industrial robot output was 103,691 units, an actual increase of 1.17% year-on-year; the output of service robots was 1,450,428 sets, a year-on-year decrease of 20.6% (of which sweeping robots accounted for more than 90%).

According to the observation of Gaogong Mobile Robot, driven by strong market demand, China’s mobile Robot Industry has ushered in explosive growth in recent years. gold and silver”.

Even in 2022, known as the “capital winter”, there were a total of 298 financing events in the field of robotics, with a total financing amount of over 30 billion.

However, from the market situation in the first quarter of 2023, it is not difficult to find that the current mobile robot track has entered the period of “slot” for top companies, and capital will be more biased towards “top” companies.

And mobile robots have passed from the stage of market cultivation to the stage of rapid growth. We have observed that there will be differentiation among mobile robot players next. This also shows from one aspect that the preference of capital will accelerate the differentiation of enterprises.

From the perspective of market dynamics, in order to always keep ahead in the fiercely competitive market, leading companies have also stepped up new product development efforts and accelerated the pace of landing applications in new scenarios, which has undoubtedly become a bright spot for attracting capital.

02 In the first quarter, the overall growth of orders exceeded 30%, and the overall demand of the photovoltaic industry remained strong

According to GGII research data, the national GDP will grow by 4.5% in the first quarter of 2023, mainly driven by the service industry, while the recovery of the manufacturing industry is slow, and corporate profits have dropped significantly.

At the level of orders, the overall growth of orders in the first quarter exceeded 30%, but there was a clear differentiation phenomenon among enterprises, some enterprises increased significantly, and some enterprises showed relatively weak growth. The scale of single orders has increased, and corporate orders have also changed from “seeking quantity” to “seeking quality”, and the enthusiasm for going overseas and overseas investment have increased significantly.

In terms of downstream applications, the recovery of demand in various industries is not as good as expected, and the photovoltaic industry is thriving, with orders increasing by more than 100% in the first quarter; the performance of the two major industries of automobiles and 3C is not satisfactory.

GGII believes that the recovery node of manufacturing demand will appear in the second half of the year, and the domestic focus is on the demand brought about by the recovery of industries such as automobiles and logistics.

In terms of new energy vehicles, it is worth noting that in Q1 of 2023, the cumulative production and sales of automobiles were 6.21 million and 6.076 million, a year-on-year decrease of 4.11% and 6.55%, showing a slight decline; the cumulative production and sales of new energy vehicles completed 1.65 million and 1.586 million. million vehicles, a year-on-year increase of 27.7% and 26.2% respectively.

In the first quarter, the 3C electronics industry continued its downward trend, and the output of mobile communication handsets, color TV sets, integrated circuits, and microcomputer equipment all showed negative growth; the photovoltaic industry continued to thrive, with a cumulative increase of 53.2% in output in the first quarter, and overall demand remained strong.

In terms of manufacturing, manufacturing investment in the first quarter was +7% year-on-year, a drop of 1.1 percentage points from January to February, corresponding to a year-on-year +6.2% manufacturing investment in March. The decline in the growth rate of manufacturing investment may be mainly due to the lagging effect of the previous decline in export growth rate, but the structure still reflects the support of high-tech manufacturing investment.

In the first quarter, the investment in high-tech manufacturing was +15.2% year-on-year, which was higher than the overall manufacturing investment. Among them, the year-on-year growth rates of investment in electrical machinery and equipment manufacturing, automobile manufacturing, and electronic equipment manufacturing in the first quarter were 43.1%, 19%, and 14.5%, respectively.

03 The capital market returns to rationality The robot industry has entered a “shuffle period”

Gaogong Mobile Robots observed that while a large amount of capital is pouring into the mobile robot industry, small and medium-sized enterprises do not have the same rain and dew as the top companies, but seem a little lonely.

At present, the robot industry has entered a “shuffle period”. The biggest feature of this year is that the capital market is returning to rationality. There is less money in the market, and institutions are not as aggressive as in previous years. When it comes to enterprises, the Matthew effect has intensified, leading companies have more obvious advantages, and middle-tier companies have become more difficult.

The reason why leading companies are favored by capital is largely because leading companies already have mature products for the market and have begun to sell them widely. Many companies have also seen continuous repurchase by customers, and the future is bright.

Therefore, among the two to three hundred mobile robot start-up companies in the country, there are only three or two that can earn 1 billion yuan. Leading companies can get investment to continue to develop, expand production capacity and scale, while most small and medium-sized companies are struggling, some will fall, and the other part will have to turn to a segment that is more suitable for them to deepen their cultivation and build their own barriers.

Therefore, the mobile robot industry has entered a stage of reshuffle, and the world economic situation and international environment have brought more uncertainties and unpredictable challenges to the development of enterprises.

But this does not mean that after the reshuffle, it will be the end, because the future industrial manufacturing scene will be bigger, and it is impossible for one or two companies to eat all of them. It is conservatively estimated that before 2025, the mobile robot industry will still maintain a compound growth rate of 30% to 40%, and there is still a lot of room for growth in the future.

04 Upstream technology, midstream cost, downstream industry ROI

my country’s long-term low birth rate has led to a reduction in the demographic dividend, coupled with the rise of emerging industries, the demand for mobile robots has become increasingly strong. But this does not mean that there are financing opportunities when entering this market. Among them, the investment strategies of some capital companies are worth analyzing.

The summary of Gaogong mobile robot is: upstream technology, midstream cost, downstream industry ROI.

① The core of the upstream component link depends on technology. Many cases observed from Gaogong mobile robots show that only with core technological advantages can Ontology companies have to purchase in batches, and a stable market can attract the attention of investors.

② The core of the midstream ontology link is cost. Whether it is a six-axis, collaborative or AMR mobile robot, it can be made into a standardized product. The scale effect brings down the BOM cost, and then the integrated research and development of parts further reduces the cost. When the technology gap is not large, the cost becomes the core competitiveness.

③ The core of the downstream integrated application link depends on the industry’s cognitive ROI. Robots are applied in specific scenarios, and the scenarios vary widely. Only by deeply understanding the pain points, requirements, and standards of the scenarios, and capturing, analyzing, understanding, training, controlling, and optimizing algorithms for massive data in the scenarios can they become real barriers and evaluate specific The commercial value of the scenario is ROI for the buyer. Including narrow sense ROI and general sense ROI.

In a narrow sense, ROI refers to the return cycle of the value created by the robot after the buyer purchases the robot. Generally, 1 to 2 years is more popular.

In a broad sense, ROI refers to the fact that robots can perform tasks that cannot be performed by human resources or are harmful to health at the same cost, such as dangerous scenarios. Another example is that buying a welcome robot may be far more expensive than hiring a lobby manager, but it can demonstrate the technological attributes of the bank to the outside world.

05 end

Policy dividends and China’s economic development have entered a new transition period, and are transforming from a manufacturing power to a manufacturing power. Therefore, the Chinese robot market is booming under the background of new infrastructure and smart manufacturing in 2025. The window of opportunity has arrived, and the industry must Will usher in a stable and continuous growth trend.

The continuous expansion of the market scale will also promote the deep upgrading, integration and development of the robot industry chain. It also directly led to the influx of a large amount of funds into this track, which accelerated the competition among players.

Therefore, it takes a very long period of time for robots to go from project approval to real commercialization. In fact, this is more like a capital gamble. If you win, you will take off with the wind, and if you lose, your previous efforts will be wasted. This is a kind reminder for those who want to enter the market and investors who want to enter the game.

However, in the global manufacturing industry, the most common use of mobile robots is handling, mainly in the automotive industry, 3C electronics, chip manufacturing, logistics packaging and other industries. In the case of rising labor prices in my country, AGV and AMR mobile robots make up for the labor shortage in my country’s manufacturing industry, and also provide conditions for the digital transformation of my country’s manufacturing industry.

Before the Spring Festival in 2023, 17 departments including the Ministry of Industry and Information Technology issued the “Robot +” Application Action Implementation Plan, which clarified the development goals and plans of the robot industry.

The plan points out that by 2025, the density of manufacturing robots will double compared with 2020, the application depth and breadth of service robots and special robots will be significantly improved, and the ability of robots to promote high-quality economic and social development will be significantly enhanced.

The plan also mentioned that the application scenarios of robots will continue to expand in the future, especially in industries such as medical care and elderly care, which will generate a large demand for service robots.

As a result, China’s robot industry has been pushed into a new policy dividend period.

The continued favor of the capital market has also given a boost to the mobile robot industry.

From the continuous rise in labor costs to the reduction in the production cost of mobile robots… these have led to a large number of investors pouring into the mobile robot track.

The Links: 3HAC029024-001 KCP2 00-130-547 IGBT

Pre: ARM and Horizon Robotics jointly esta... Next: Weidmüller THM MultiMark LPC (Label P...