The first share of “Smart Factory Manufacturing” is here! It soared 300% on the first day

May 12, Ningxia JunengrobotCo., Ltd. (hereinafter referred to as “Juneng shares”) was officially listed on the Beijing Stock Exchange, becoming the first listed company after the comprehensive registration system reform in Ningxia, and also the first “smart factory manufacturing” stock on the Beijing Stock Exchange.

According to the data, Juneng was established in June 2008. It is a supplier of intelligent manufacturing overall solutions with Robots and related intelligent technologies as the core. It is committed to building automated, less-staffed, and intelligent factories for customers. “The Factory That Makes the Smart Factory”.

Juneng has won many titles such as National High-tech Enterprise, National Green Factory, National Key Specialized and New “Little Giant” Enterprise, and is a leading enterprise in the field of intelligent manufacturing solutions in China. In April 2022, Juneng will be promoted to the In September of the same year, the innovation layer of the “New Third Board” submitted an IPO application to the Beijing Stock Exchange and was accepted. It took less than 7 months from application to registration, setting a record for the shortest mentoring period for Ningxia enterprises.

Many honors have made Juneng shares sought after by the secondary market. After the opening of the market today, the stock price has risen all the way, with an increase of 300%. As of the close, it has risen by 227.27%. The stock price is 18.00 yuan, with a total market value of 1.323 billion.

Revenue and profit continue to grow

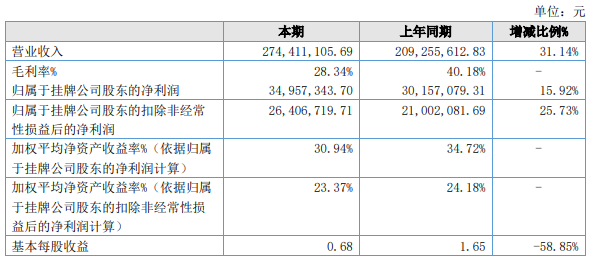

According to the prospectus, from 2020 to 2022, Juneng shares will achieve operating income of 152 million yuan, 209 million yuan, and 274 million yuan respectively, with a compound growth rate of 34.24%; realize deduction of non-net profits of 11.9288 million yuan, 21.0021 million yuan, and 26.4131 million yuan. million, with a compound growth rate of 48.80%.

In terms of gross profit rate, the gross profit rate of Juneng shares in 2022 will be 28.34%, which is a sharp drop of 11.84 percentage points compared with 40.18% in 2021. Factors such as the raging epidemic and rising raw material prices in 2022 will cause the robot industry to rise in prices one after another, pushing up the cost.

In terms of research and development, in 2021 and 2022, Juneng’s R&D expenditures will be 22.31 million yuan and 35.6 million yuan respectively, an increase of nearly 60% year-on-year, and the proportion of revenue in that year will also increase from 10.66% to 12.97%. By the end of 2022 , the number of patents and invention patents owned by Juneng shares are 187 and 72 respectively.

Now Juneng has formed a number of its own core technologies, including truss robot design/manufacturing/installation technology, vision application technology in the field of automation, robot automatic grinding and deburring technology, etc., and has differentiated competitive advantages among companies in the same industry.

As of the end of 2022, the net cash flow generated by Juneng’s operating activities was 20.915 million yuan, a decrease of 50.74% compared with the same period in 2021, mainly due to the impact of the new crown pneumonia epidemic, some customers have delayed payment. When the epidemic is fully liberalized, it will be eased.

It is worth noting that Juneng seems to be facing greater debt repayment pressure. From 2019 to 2022, the asset-liability ratios of Juneng Robotics are 79.45%, 76.40%, 71.56% and 57.25%. Juneng previously stated that the company The high level of asset-liability ratio is mainly because the industry in which the company operates has a large demand for working capital.

Deeply cultivate the field of intelligent manufacturing of new energy vehicles

Juneng is a rare domestic high-end product on the marketIndustrial robotA solution provider whose core business is Robotic automated production lines, accounting for more than 90% of its revenue. Its products are widely used in high-end manufacturing industries such as auto parts, construction machinery, aerospace, military, and rail transit.

According to the prospectus, Juneng has delivered more than 1,500 automated production lines to customers, serving customers including Shaanxi Hande Axle, Shaanxi Fast Group, BYD, Dongfeng Honda, GAC, FAW, Guangdong Hongtu, Wencan Co., Ltd., Longji Machinery , Fine Forging Technology, Kehua Holdings, Tianrun Industry, Weifu Hi-Tech, Xiangdian Electric Co., Ltd. and other industry benchmarking enterprises.

The data shows that the sales volume of Industrial robots in China will exceed 300,000 units in 2022, accounting for more than 50% of global sales. The increase in demand will mainly come from the fields of new energy vehicles, photovoltaics, lithium batteries, and semiconductors, especially the development trend of new energy vehicles. Well, the market is booming in production and sales, and new energy car companies represented by BYD are accelerating production expansion, and at the same time vigorously boosting the market demand for automation.

The automobile industry has always been the deep cultivation area of Juneng, and most of the sales revenue comes from this. Benefiting from the continuous improvement of the prosperity of new energy vehicles, in the first half of 2022, the sales revenue of Juneng in the field of new energy vehicles will exceed that of 2021. More than 4 times throughout the year, achieving rapid growth. As of October 31, 2022, the company’s new energy vehicle field has an order amount of 99.204 million yuan, accounting for 47%.

In 2023, the demand for new energy vehicles and emerging industries will continue to be strong, and the automation demand for new energy vehicle parts manufacturing will continue to be driven. The development of energy shares will bring new growth opportunities.

The Links: 3BSE018135R1 6AV6642-0DA01-1AX1

Pre: Robots perform surgery, do you dare t... Next: From 1 to N, this secret weapon you m...