“Panorama of China’s UAV Industry in 2023” (with market size, competition pattern and development prospects, etc.)

Industry Overview

1. Definition and classification of drones

UAV is an unmanned aircraft operated by radio remote control equipment and self-contained program control device. There is no driver on board, but equipment such as autopilot and program control device are installed. The personnel on the ground, on the ship, or at the remote control station of the parent aircraft track, locate, remotely control, telemeter and digitally transmit it through radar and other equipment. In a broad sense, winged missiles can also be regarded as an unmanned aircraft, but the drones mentioned in this report mainly refer to unmanned aircraft without a pilot.

UAVs can be divided into military and civilian categories according to their uses, and they are also used for scientific research.

2. Analysis of the Industrial chain

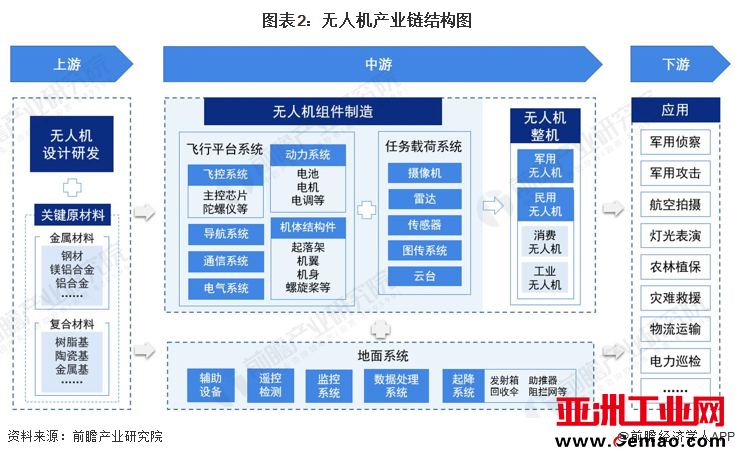

The upstream of the drone industry chain is the design and development of drones and the production of key raw materials. The key raw materials include metal materials and composite materials, including special materials such as titanium alloys, aluminum alloys, and ceramic bases.

The manufacturing of UAVs in the midstream includes three aspects: flight system, ground system, and mission load system. It is the core part of UAV manufacturing. The flight system includes power systems, navigation systems, flight control systems, communication systems, and airframe manufacturing. It is the core system for the UAV to complete the entire flight process such as take-off, air flight, mission execution and return to the field for recovery.

The downstream of the UAV industry chain is the application scenario of UAVs. UAVs can be used in military reconnaissance, military attack, aerial photography, light show, agriculture, forestry and plant protection, disaster rescue, logistics transportation, power inspection and other fields.

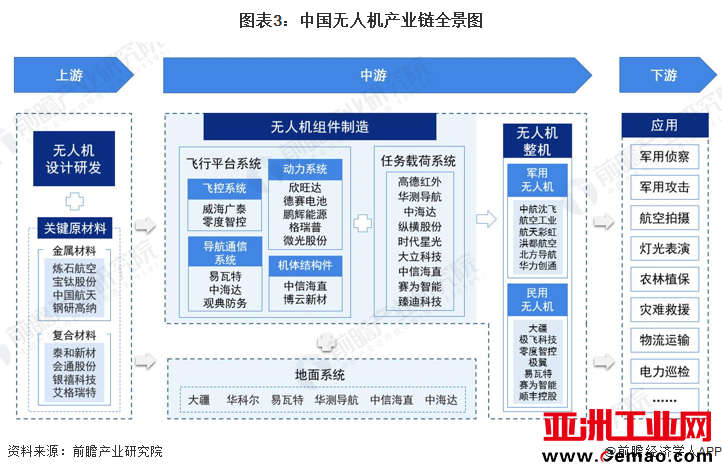

The upstream representative enterprises of the UAV industry chain mainly include Lianshi Aviation, Baotai, China Aerospace, Taihe New Materials, Huitong, Silver Jubilee Technology and other enterprises.

The representative enterprises of flight control system in the middle reaches of the UAV industry chain include Weihai Guangtai, Zero Intelligent Control, etc.; the representative enterprises of power system include Sunwoda, Desai Battery, Penghui Energy, Grape, and Shimmer, etc.; navigation Representative companies of communication systems include Ewatt, China Hi-Target, Guandian Defense, etc.; representative companies of airframe structural parts include CITIC Haizhi, Boyun New Materials, etc.; Dali, Zongheng, Times Starlight, Dali Technology, CITIC Haizhi, Saiwei Intelligent, Zhendi Technology, etc.; representative ground system companies include DJI, Walkera, Ewatt, CTI Navigation, CITIC Haizhi, Zhonghai-Target and other enterprises.In the manufacturing process of UAVs, representative enterprises of military UAVs include AVIC Shenfei, AviationindustryAerospace Rainbow, Hongdu Aviation, North Navigation, Huali Chuangtong, etc.; representative enterprises of civil drones include DJI, Jifei Technology, Zero Intelligence Control, Jiyi, Ewatt, Saiwei Intelligent, SF Holdings and other enterprises .

Industry development history

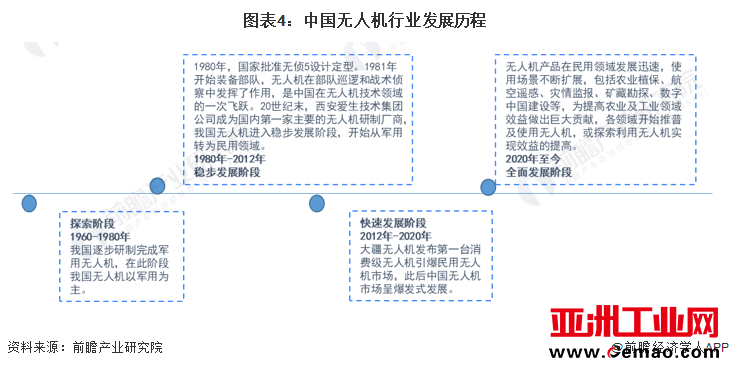

The development of UAVs in my country started from military UAVs. As early as 1960, my country began to develop UAVs. In 1964, Type I UAV target aircraft was born, and Type II UAV target aircraft was also developed in the 1970s. . Until 1980, the state approved the finalization of Wuzhen-5 design. It began to equip troops in 1981, and UAVs have played a role in troop patrols and tactical reconnaissance. This is a leap for China in the field of UAV technology. At the end of the 20th century, Xi’an Aisheng Technology Group Co., Ltd. became the first major manufacturer of drones in China. my country’s drones entered a stage of steady development and gradually shifted from military to civilian use. In 2012, DJI UAV released the first consumer-grade UAV to detonate the civilian UAV market. Since then, the Chinese civilian UAV market has exploded. Nowadays, UAV products are involved in various fields of civilian scenarios, contributing to the improvement of benefits in various fields.

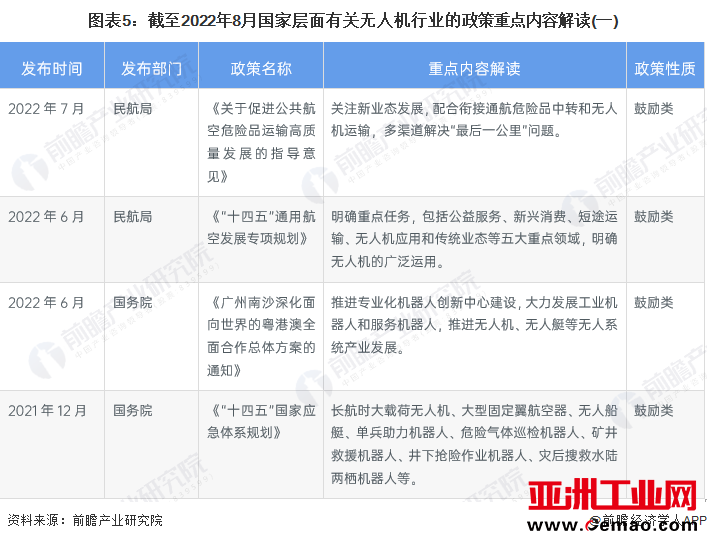

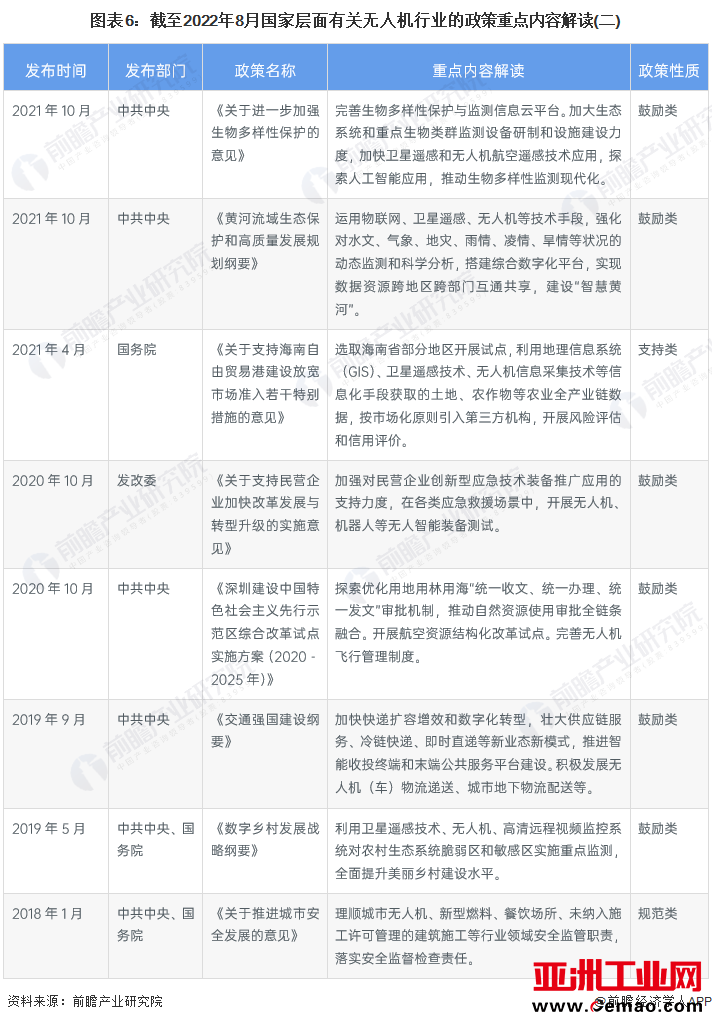

Industry policy background

China’s drone industry policy is mainly reflected in encouraging drones to be used in various fields, including plant protection, industrial development, biological monitoring, transportation services and other fields.

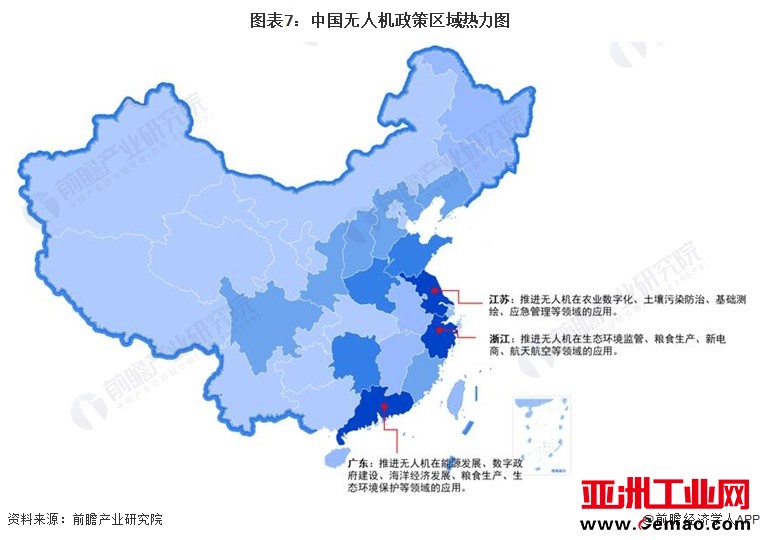

Judging from the number of policies related to the development of drones issued by provincial and municipal government departments obtained from the forward-looking statistics, the number of drone development policies issued by Guangdong, Jiangsu, and Zhejiang provinces is relatively large. The government’s drone-related policies are generally promoting the application of drones in various aspects. Among them, Guangdong mainly focuses on marine emergency development, energy development, etc., Zhejiang Province mainly focuses on aerospace, new e-commerce, etc., and Jiangsu Province focuses on soil pollution prevention and control. Agricultural digitization, etc.

Industry Development Status

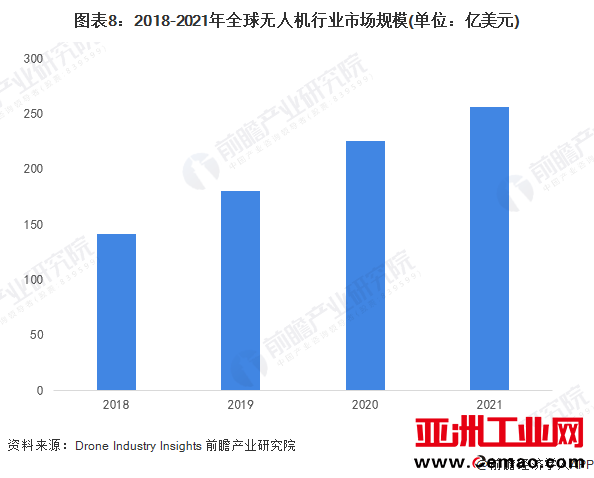

1. The status quo of the global drone industry

In the global market, drones are gradually penetrating from a consumer product to applications in various industries, and the market scale is steadily expanding. According to research data released by Drone Industry Insights, the global drone market size will be approximately US$25.6 billion in 2021, a year-on-year increase of 14%.

2. The status quo of China’s drone industry

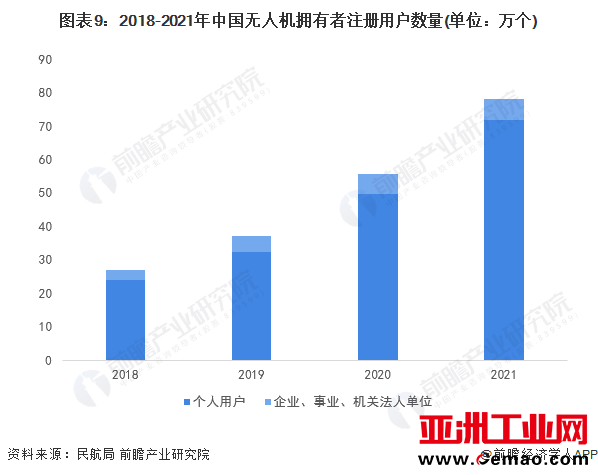

From the perspective of the number of registered users of drone owners in China, according to data from the Civil Aviation Administration, by the end of 2021, there will be 781,000 registered drone owners in the industry, a year-on-year increase of 40%. Among them, there were 718,000 individual users, an increase of 44.2% year-on-year, and 63,000 users of enterprises, institutions, and institutional legal entities, an increase of 5% year-on-year.

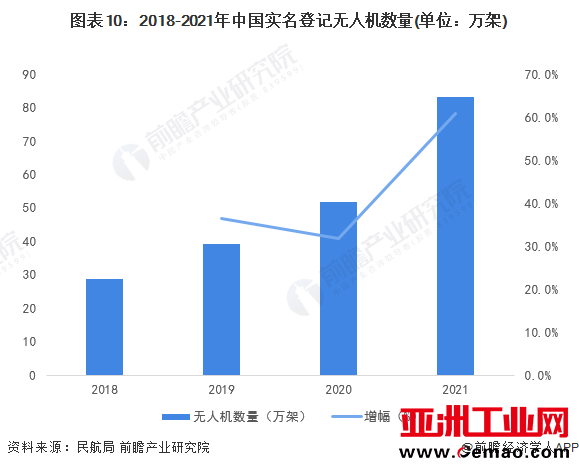

From the perspective of the number of real-name registered drones in China, according to data from the Civil Aviation Administration of China, as of the end of 2021, a total of 832,000 drones have been registered in the industry, an increase of 315,000 from 2020, or a year-on-year increase of 61%. It reflects that the development of China’s drone industry is in a stage of rapid growth.

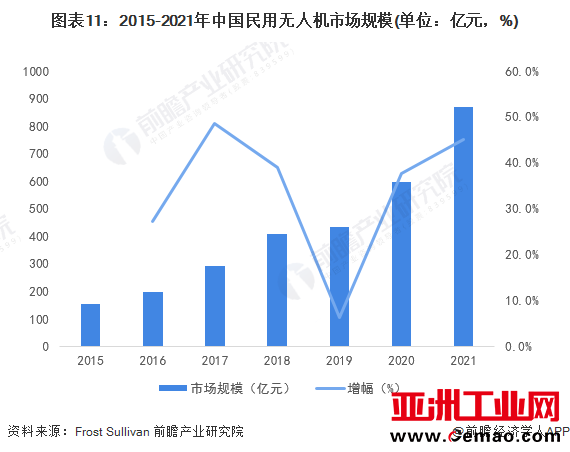

UAVs have played an important role in social development and economic construction and development. In recent years, my country’s civilian UAV market has developed vigorously. In 2021, the size of China’s civilian UAV market will reach 86.912 billion yuan, an increase of 27.008 billion yuan compared with 2020 , an increase of 45.09% year-on-year.

Industry Competitive Landscape

1. Competitive landscape of Chinese drone companies

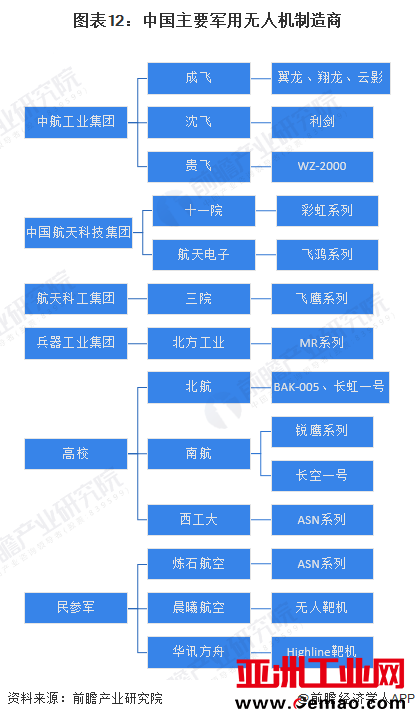

Judging from the competition pattern of China’s military UAV enterprises, at present, my country’s UAV research funds mainly come from national capital investment, and the research and development work is dominated by Beihang University, China Southern Airlines and Northwestern Polytechnical University. Research institutes and units under the Group and China Aerospace Science and Technology Corporation actively participate in the research and development work.

From the perspective of the competitive landscape of Chinese civilian drone companies, the current well-known brands of civilian consumer drones in China include DJI, AEE, Zhendi, Haoxiang, Jifei, Yihang, Walkera, Zero Intelligent Control, etc., among which The drone products of the DJI brand account for about 70% of the drone market.

2. Regional Competition Pattern of UAVs in China

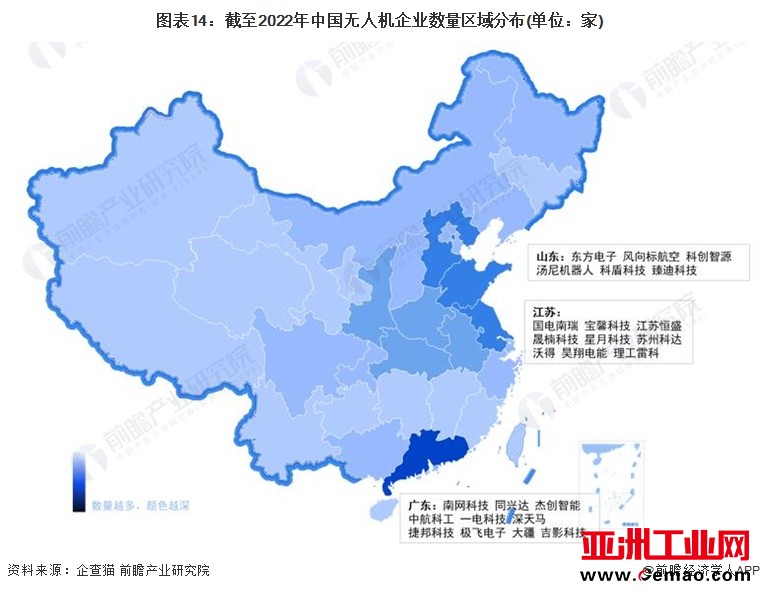

According to the Chinese enterprise database Qichamao, at present, Chinese drone companies are mainly distributed in Guangdong, Jiangsu, and Shandong provinces. As of September 2022, Guangdong has a relatively high number of companies related to the drone industry, ranking first. Representative companies include Nanwang Technology, Tongxingda, Jiechuang Intelligence, AVIC, etc., and Jiangsu Province drone companies There are Guodian Nanrui, Baoxin Technology, Jiangsu Hengsheng, etc.; companies in the drone industry in Shandong Province include Dongfang Electronics, Windvane Aviation, and Kechuang Zhiyuan. Among them, drone companies in Jiangsu Province and Zhejiang Province pay more attention to the direction of agricultural plant protection.

Industry development prospect and trend forecast

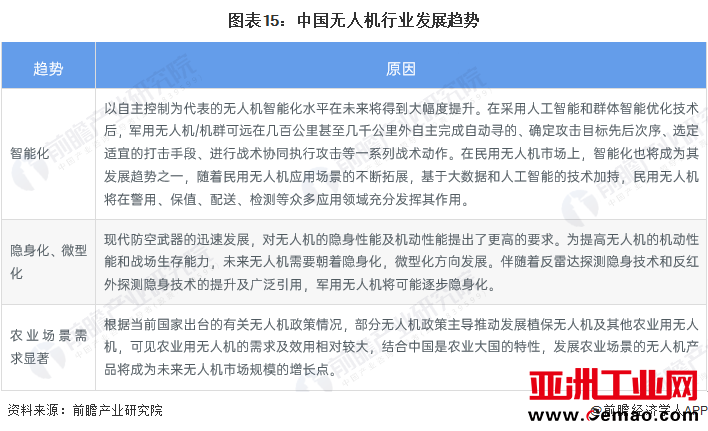

According to the current UAV development policy, the development background of the times, and the UAV market demand, China’s UAVs may develop toward intelligence, deepening, and miniaturization. At the same time, the demand for UAVs in agricultural scenarios is more significant.

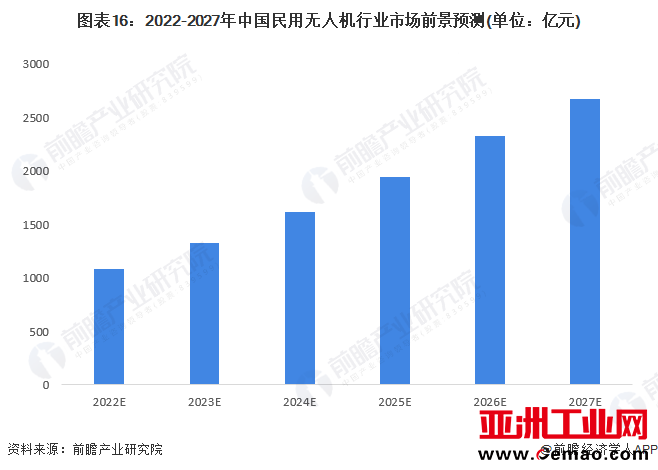

From the perspective of civilian unmanned vehicles, agricultural plant protection, aerial remote sensing, disaster monitoring and reporting, mineral exploration, and digital China construction all require the use of drones in large quantities. At present, the popularization and application of industry-level drones is accelerating. At the same time, with the participation of private enterprises, the application of domestic consumer drones has gradually begun to be promoted, and the market potential of consumer drones is huge. According to the preliminary forecast of the Qianzhan Industry Research Institute, the market size of China’s drone industry may exceed 250 billion yuan in 2027.

For more research and analysis of this industry, please refer to the “China UAV Industry Market Prospects and Investment Strategic Planning Analysis Report” by Qianzhan Industry Research Institute

The Links: 3BSE037760R1 3BSE018106R1

Pre: New product release | KUKA AMR family... Next: Intuitive Fosun’s “domest...